Here is the corrected version of the text, divided into sentences: "What's going on everybody on YouTube? Steve here with Rick and Prophet over at rakinprofit.com. Coming back to you with another video, and in today's video, I wanted to talk a little bit about taxes. Yes, taxes. I do want to say in this video, you guys obviously know I am not an accountant, a CPA. This isn't legal advice. This is just advice coming from a guy on the internet. So we'd have peon said, always take what anybody says on the internet, if they're giving you legal or tax advice when they're not an accountant or whatever, with a grain of salt. So with that out of the way, let's talk about whether to pay your income tax quarterly or at the end of the year. So as you guys know, if you're running a business, there are two types of taxes you're going to be paying. One is that sales tax to the states. So it's going to be different for each state, from my understanding. I know some states require it at the end of each month. Over here in Connecticut where I live, we have to pay the sales tax to Connecticut quarterly, so every three months. That's one part of the mix. And then the second part is the income tax that you can either pay quarterly every quarter or at the end of the year. So let's talk about should you pay your income tax quarterly or should you pay it at the end of the year? So I'm gonna tell you guys what I do. Couple years back when I first started to run my business, I decided to pay it at the end of the year. I didn't know any better, and when...

Award-winning PDF software

Federal quarterly tax s Form: What You Should Know

These forms can be found at tax filing.state.la.us/IT540ES/IT540ES.pdf. Form TDR-822, Tax Withholding for Overpayment of Tax, and Form TDR-852, Tax Withholding for Underpayment of Tax Income Tax Returns and Returns Required to Be Furnished to the Attorney General U.S. Individuals—Form 1040 Individual Income Tax Returns and returns required to be furnished to the Attorney General—forms and instructions—in-person at Louisiana Tax Department Individual Tax Returns | It's Your Yale Individual Tax Returns for the states of Indiana and Louisiana. Forms, instructions and instructions for filing individual income tax returns and returns are listed under the state of Louisiana, or individual state tax returns and returns are listed under the state of Indiana. Individual Income Tax | It's Your Yale Louisiana Residents — Individual State Tax Returns and Returns to be Furnished to the Taxation Division—forms, instructions and instructions for filing individual state income tax returns and returns are listed under the state of New or individual state and federal returns and returns are listed under the state of Louisiana. Individual Income Tax Return — It's Your Yale Individual Income Tax Information and Reporting — Federal and State—in-person at Louisiana Tax office. The New or individual state tax returns and returns are listed under the state of Louisiana, or individual state tax returns and returns are listed under the state of Indiana. Individual Income Tax — Indiana Taxation Division Indiana Individual Income Tax Forms and Instructions Individual Income Tax Returns and Returns Required to Be Furnished to the Attorney General—form and instructions for filing federal individual income tax returns and returns are found under the state of Louisiana, or individual state and federal returns and returns are found under the state of New. Individual Income Tax Return — Form IT-540ES-2, Estimated Tax for Individual, for Tax Year 2017, or individual state tax returns and returns in-person at Louisiana Tax office. Federal Individuals—Individual Income Tax Returns and Forms Required to be Furnished to the Attorney General Individual Income Tax Returns for the states of New (Indiana), North Dakota (North Dakota), Ohio (Ohio), California (California), Kansas, Nebraska and South Dakota (Kansas) Individual Tax returns for residents of the states of California and Texas.

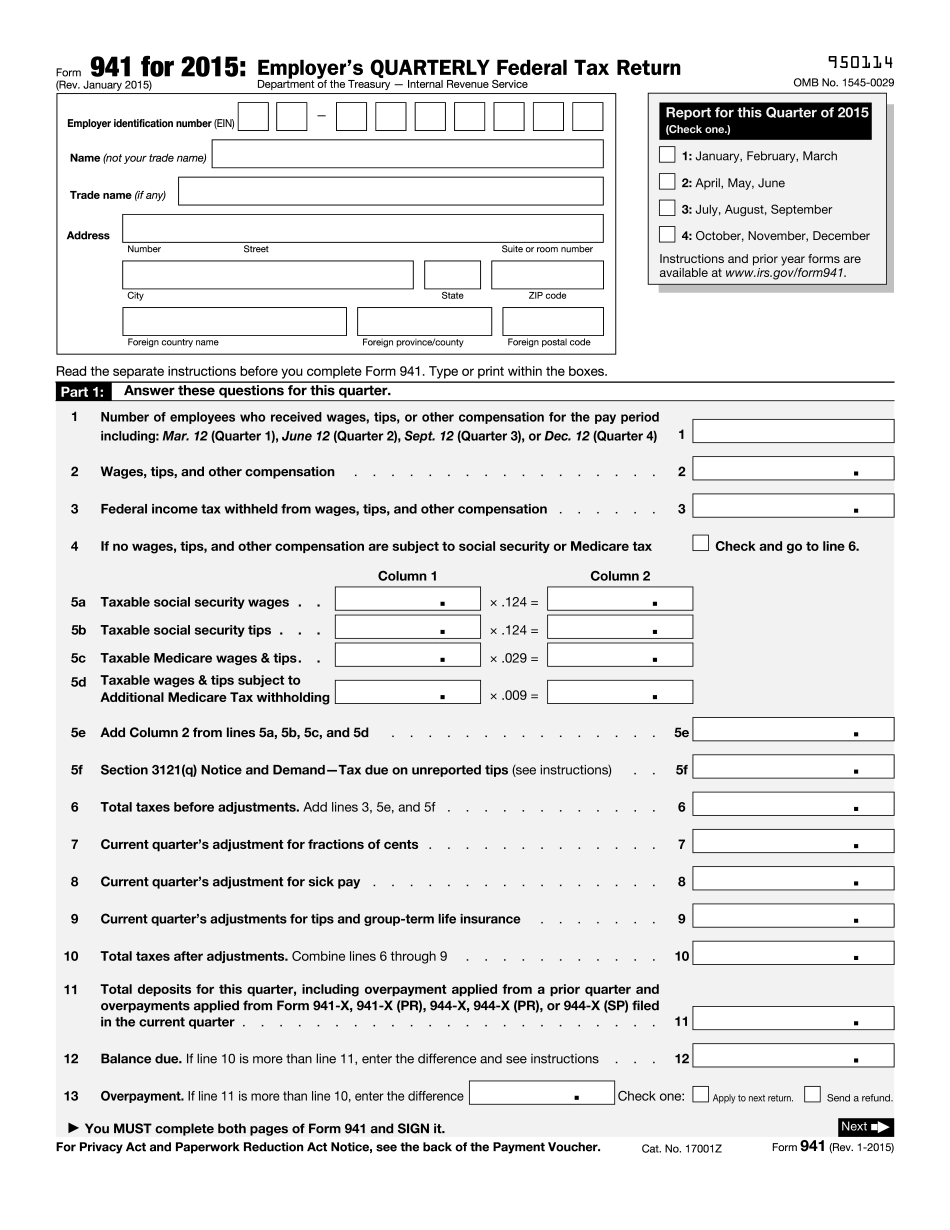

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 941, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 941 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 941 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 941 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Federal quarterly tax forms