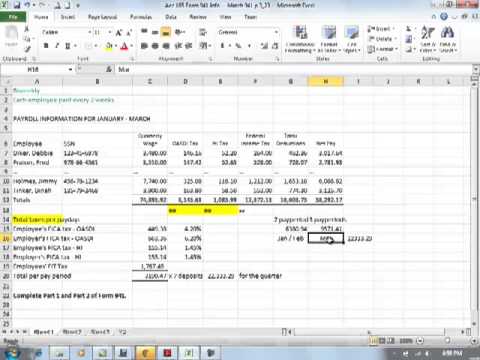

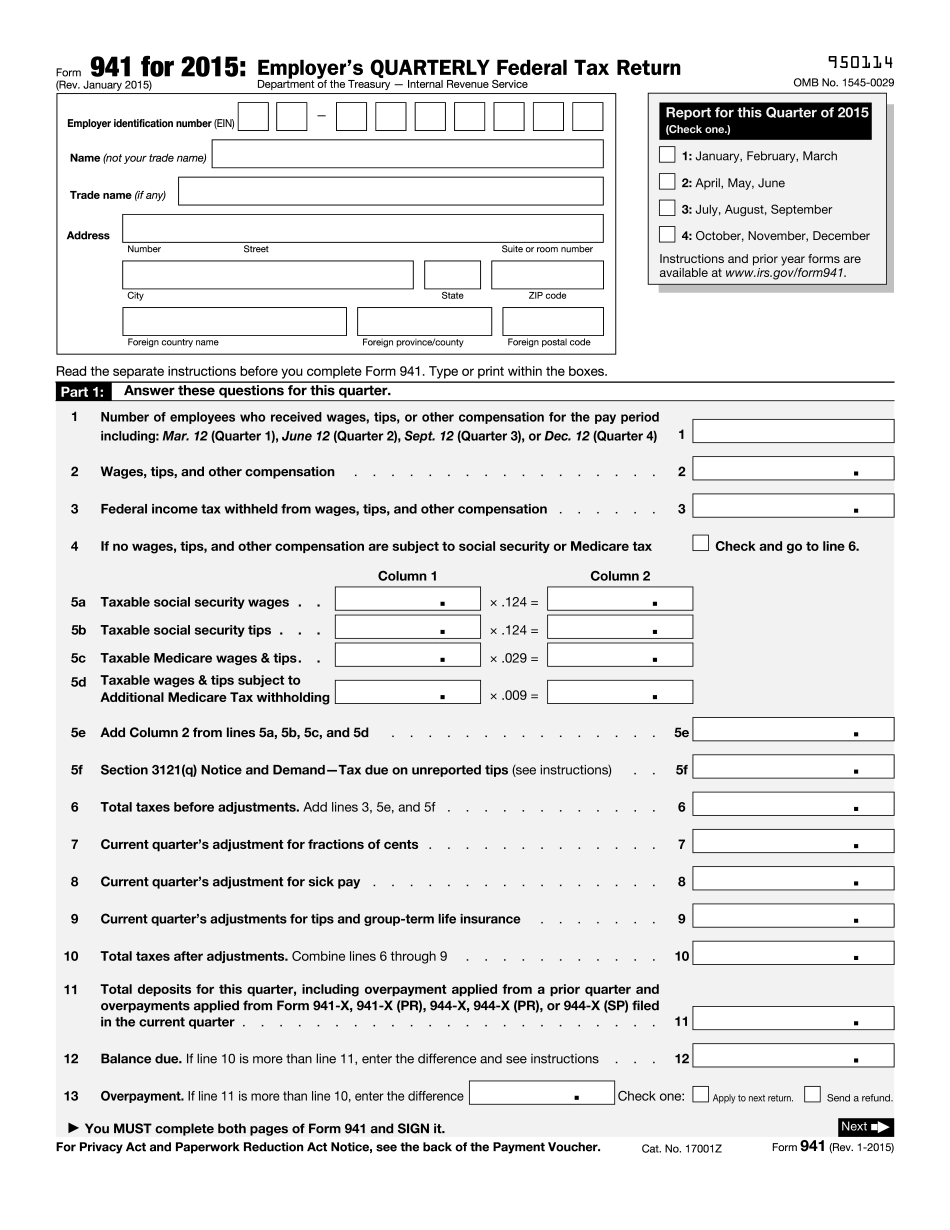

Continuing on with our discussion of Form 941, we have reviewed the company information at the top and reported the quarter. We have entered information for the company down through line 6. To complete lines 7 through 15, we need to refer back to the company's payroll report. I have added some information regarding the total for our quarterly wage, OASDI from the employee side, Medicare for the employee side, and federal income taxes for the employee only. Next, we looked at the amount of OASDI that we would have had if it were equal for every pay period. This example was mentioned in the book, so I included it for our understanding of the forms. The amount we have for each pay period is calculated at the rate of 4.2 percent. The employee or FICA tax for OASDI is calculated by multiplying the total wages by 6.2 percent. To calculate the H I tax, I divided the previous amount by seven, as indicated in the book. Using a formula in Excel, I rounded it to the nearest penny, and it came out to be $15.14. Again, this is divided by seven pay periods. For both the employee and employer, the H I tax is 1.45 percent. The amount for employees' federal income tax withholding is calculated by dividing the total by seven pay periods. This gives me the total taxes per payday, which I added up. To calculate the total liability of federal taxes, I multiplied the liability by seven deposits. As this is a semi-weekly depositor, they have to send in deposits after every pay period instead of waiting until the end of the month. This gives us the total liability for the quarter. Lastly, I added another piece of information.

Award-winning PDF software

2014 941 schedule b Form: What You Should Know

For forms that are for 2025 tax years, the PDFs are in the 2025 section.) 2014 Tax Forms Tax Liability for Semiweekly Schedule Depositors 2025 Tax Forms. (2013 section) Pay any taxes due and interest due immediately. (Forms that have been filed, are awaiting approval, and have not yet gone through the processing time limit, will continue to be filed through April 30, 2014. If any portion of the payment is due before that time, a late payment penalty will apply.) Filling out the Form 941 (Schedule B) Step 1: Fill out the Schedule B (941 form). A printable copy of Schedule B is available for download on IRS.gov under Form 941 (Scheduled). Use this page to print Schedule B. You will also need to fill out this chart.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 941, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 941 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 941 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 941 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 form 941 schedule b