In this section, we're going to talk about income and specifically line 7. Wages, salaries, and tips are the main source of income for most people. To find your income information, you will need to refer to your W-2 form. Your wages, tips, and other compensation can be found in 1. Additionally, you will also see 2, which displays the federal income tax withheld. It is crucial to have this information for reporting purposes. The IRS requires that you report all tip income, even if you didn't report it to your employer. Any unreported tip income should be included in your total on line 7. Furthermore, if you receive dependent care benefits, these should be reported and will be shown on 10 of your Form W-2. For those with a scholarship or fellowship grant, it is important to include this on line 7 as well. However, if you're a degree candidate, you only need to include the amount used for expenses other than tuition and course-related expenses. Tuition and book expenses are not subject to taxation in this case. If you have income from a disability pension, this will be indicated on your Form 1099. Similarly, if you haven't reached the minimum retirement age set by your employer, this amount must also be included on line 7. This information can be found on Form 1099-R, and you can determine what to include based on the taxable amount shown in 2a.

Award-winning PDF software

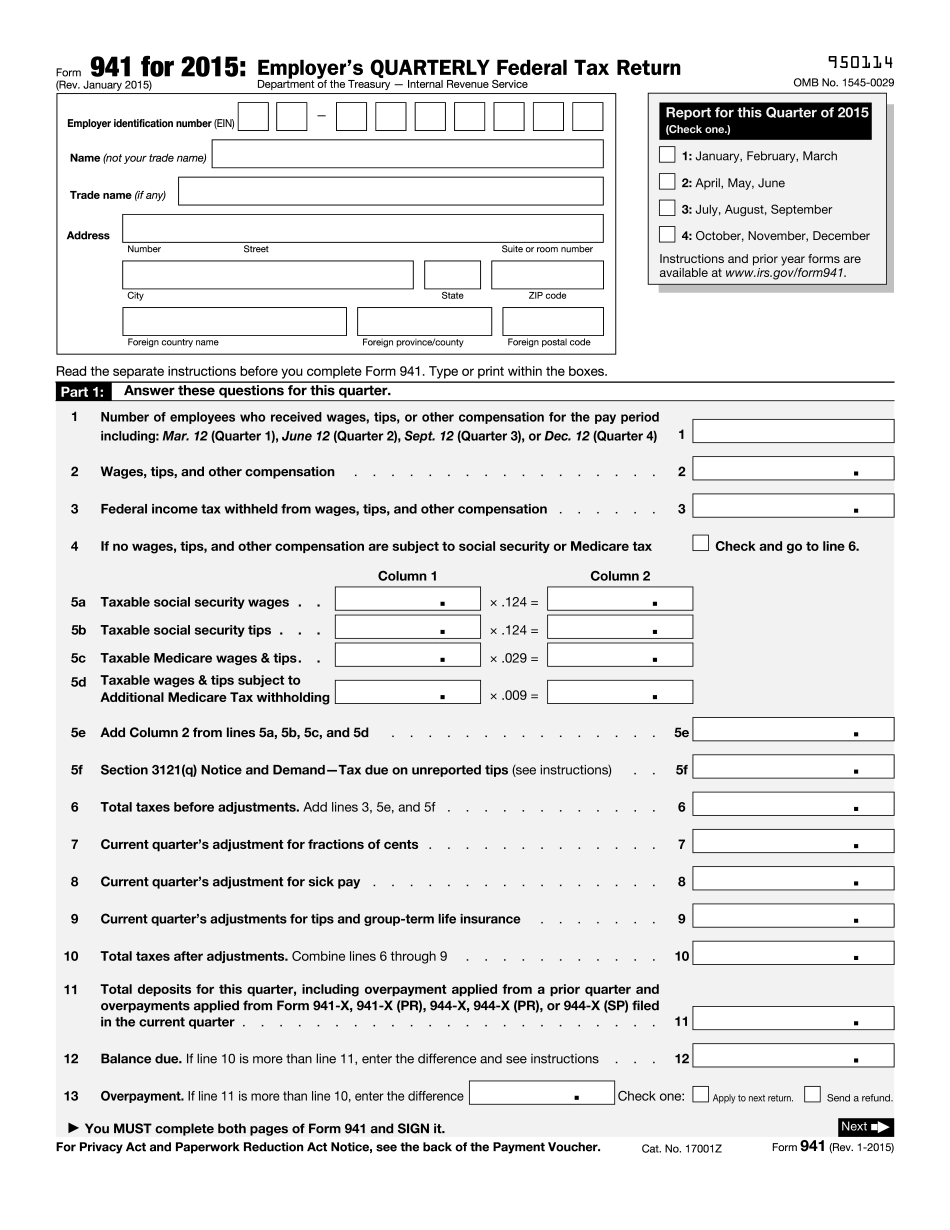

How to calculate line 7 on 941 Form: What You Should Know

How to Use Fractions of cents on the 941 — Patriot You'll need to complete a calculator like one of the following to determine the amount of the penny adjustment: The IRS Calculator (Form 941) (free) If you have an IRA, 401(k) plan, or pension from work If you've worked for more than three quarters that year, see the Federal Income Tax Worksheet for Non-Filers who are Over 65 (PDF). You can find the full list of rules here. Fractions of cents on the 941 — IRS This calculator will give you the estimated total, if you enter the following amounts: 1. The amount shown in the first column of box 1; 2. The same amounts shown in the second column of boxes 1 through 2, and 3. The same amounts shown in the third column of boxes 1 through 3. Here are the estimated amounts you'll have to write on line 7 of the 941 to get the correct amount. If you were in a work-provided pension plan or a state or local benefit plan on Sept. 30, 2016, the estimated amount you need to fill out this line will be reduced by the amount you owe on those benefits. These worksheets will be on IRS.gov for years 2025 and 2018. Fractions of cents on the 941 — The IRS See the Calculator for the number of pennies to enter on line 7. You can view this calculator on IRS.gov. How to Fill Out Form 941 (2022 Q4 Version) — Patriot Software Line 7 is for you to report these types of penny discrepancies. Say you paid 22,000.01. You'll need to fill out 2 quarters of 30,000.00 as follows: January: 5,500.12 February: 3,000.00 March: 3,000.00 April: 2,000.00 May: 2,000.00 June: 1,000.00 July: 1,000.00 August: 3,000.00 September: 1,000.00 November: 1,000.00 December: 1,000.00 Do not fill out line 7 without the proper amount of pennies on all the boxes.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 941, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 941 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 941 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 941 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to calculate line 7 on form 941