Award-winning PDF software

What is 941 and when must it be filed Form: What You Should Know

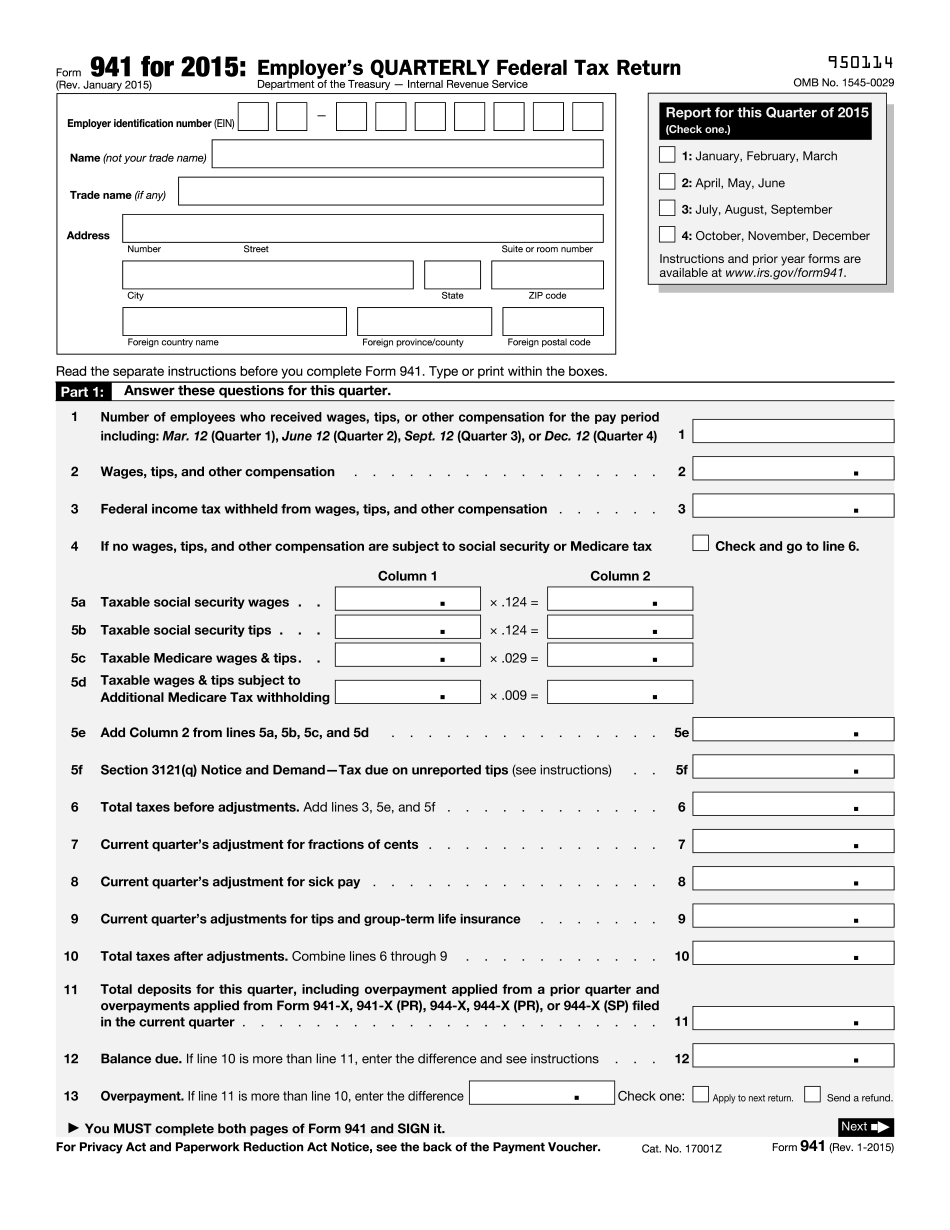

December, January, and June. IRS Form 941 Tax-Deduction Estimator — Filing Tips for Small Businesses Mar 25, 2025 – We've created the most helpful and customizable tax form you'll ever need to file. Get started with our handy interactive tax form! Filing Information From the Internet — NerdWallet Oct 9, 2025 — Use Taxa to file your income taxes on the web. You can also use taxa to prepare your return by downloading our free tax forms. About IRS Online Tax Filing — Free Website Guide Mar 25, 2025 — The IRS will provide free tax forms online at IRS.gov starting on October 22, 2018, and continuing until the end of 2019. Filing Form 941, Employer's Quarterly Federal Tax Return You are required to report wages you paid and tips your employees have reported to you, as well as employment taxes (federal income tax withheld, social security and Medicare taxes withheld, and your share of The amount of federal tax paid to the IRS is deducted from the employee's wages before the employee receives any wages in payment. The employer, meanwhile, withholds a percentage of the employee's pay as employment taxes. What Are The Forms? Form 941 is an official, 10-digit IRS tax form, and it must be filed quarterly unless you have an exemption from filing by filing an form has similar instructions and forms and instructions for businesses of 50 employees or fewer and any type of employer that has more than 50 employees, such as farm or domestic businesses. What Forms Are Required to File the Forms? Forms 941, Employer's QUARTERLY Federal Tax Return and Form 944, Employee's ANNUAL Federal Tax Return Form 941, Employer's QUARTERLY Federal Tax Return You file Form 941. You must file Form 944 if your employee is a salaried employee who makes, or is paid for services, more than 50,000 in wages in the year. Employees filing Form 941 have six years from the close of the taxable year to file a state-level return to pay any federal income tax. The employee may defer the federal income tax that would otherwise not have been paid by filing a state-level return. If the employee has failed to make such a filing, the state will begin to collect from the employee.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 941, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 941 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 941 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 941 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.