Hi, this is Seth David from the world-famous Nerd Enterprises Incorporated, bringing you another special screencast. This time, we're talking about how to enter payroll into QuickBooks. The detailed method is important for knowledge and making an impact. If you want to learn more, call me right now at 866-945-8074 for information about private trainings. We always record the live session with you, so you can review it as often as you like afterwards. So, let's begin by entering payroll in the detailed format. If you want to check out the summary form afterwards, there'll be a link at the end of this video that will take you there and show you the difference. Entering payroll in the detailed format requires several steps. First, we have to go to our chart of accounts to see what we need. The first thing we need to do is add a fictitious bank account called "Payroll Clearing". This bank account is where we'll enter each individual paycheck. This is important because the goal is to enter each paycheck in detail. Once we have the bank account set up, you'll see how each individual paycheck is recorded here rather than in our actual bank account. This is necessary in order to track and calculate the total net payroll amount that comes out of our bank account. To demonstrate how this works, let's go over to Excel. In a typical summary payroll report, you'll find the information laid out as shown on screen. However, since we want to enter payroll in detail, we need the specific details from this report. Correct format: Hi, this is Seth David from the world-famous Nerd Enterprises Incorporated. I bring you another special screencast. This time, we're talking about how to enter payroll into QuickBooks. The detailed method is important for knowledge, making...

Award-winning PDF software

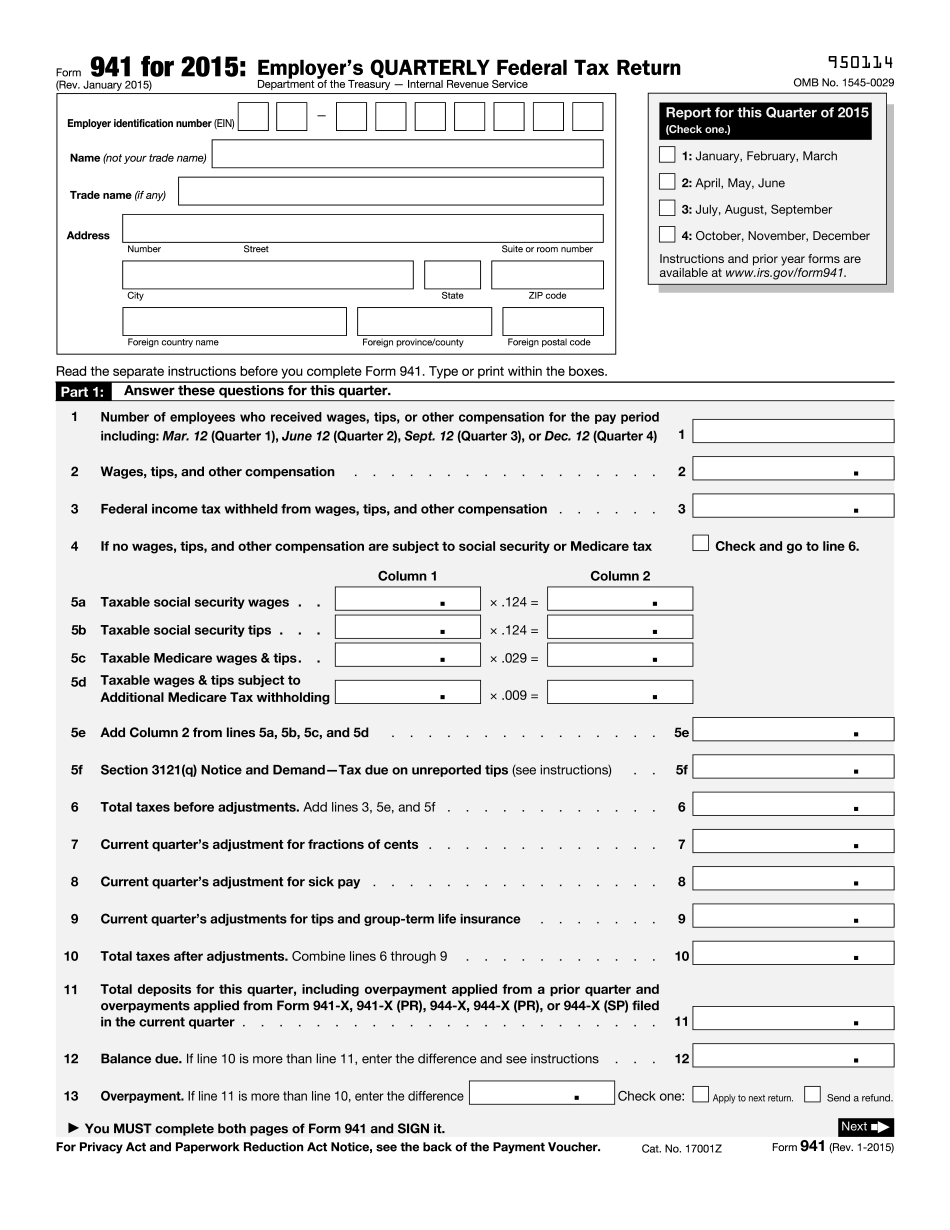

Irs tax 941 2025 Form: What You Should Know

Form 941 (Rev. January 2016). Prior Year Products. Report income taxes, Social Security and Medicare taxes, or withholding from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax. Form 941 (Rev. January 2016) — Prior Year Products Prior Year Products For Individuals: Filing a 1040-ES, 990 or 990-EZ — Self-Employed Individuals If the social security numbers on this form are different from the SSNs provided with the return, please contact the Internal Revenue Service at. The Social Security Administration can be reached at. Please do not call the Taxpayer Assistance Program at or use the IRS Direct Mail service at. Filing a 1040-ES, 990 or 990-EZ — Self-Employed, Jointly Employed, or Partner Collectors and Partners If the SSNs provided with this return are not the SSNs provided with the return, please contact the Internal Revenue Service at.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 941, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 941 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 941 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 941 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs tax form 941 2025