Welcome to Tax Bandits, the most secure way to complete your quarterly taxes online. When e-filing Form 941, the IRS requires a valid electronic signature as an extra line of defense to ensure that the person filing your business taxes is actually you. After logging into your Tax Bandits account, click on "Start New Forms" for the Employee Tax Return (Form 941). On the next page, you can either fetch the organization details from your Tax Bandits address book or enter new taxpayer identification information. The following page will require you to enter the signing authority and contact details before requesting an Electronic Filing PIN (Personal Identification Number). Once you request a new PIN, the IRS will mail it to your address. Upon receiving the PIN, you must sign and return a statement, acknowledging receipt of the PIN, within 10 days for activation. It takes approximately 45 days for the PIN registration process to be completed. Alternatively, you can use the option of signing Form 8453-EMP and transmitting the return to the IRS. To get started on your quarterly taxes, visit TaxBandits.com. This video was brought to you by Tax Bandits, helping you save time and improve efficiency when filing taxes for small businesses and nonprofits.

Award-winning PDF software

Irs s 941 2025 Form: What You Should Know

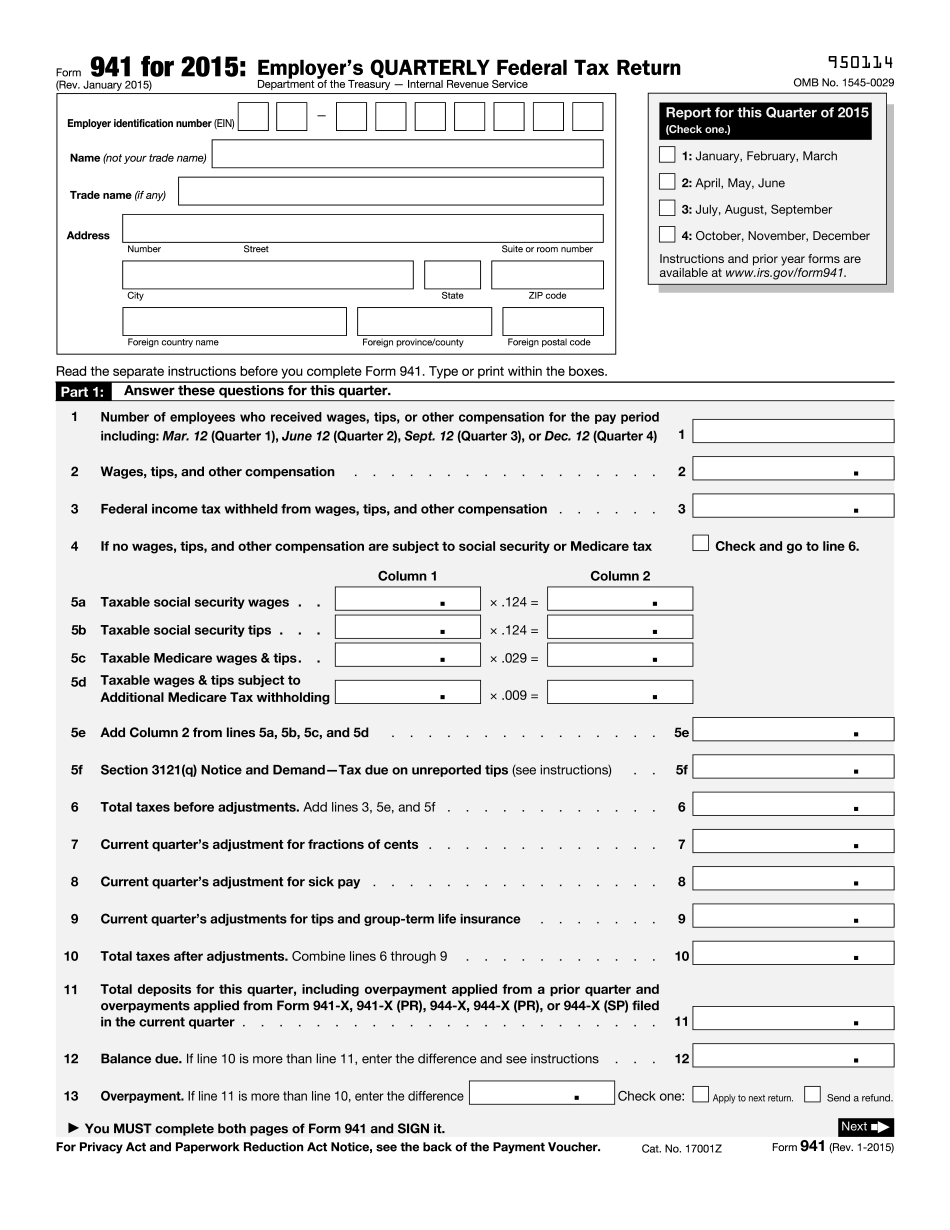

Form 941 (Rev. January 2016) — IRS Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors. Use the following table to report tax liability. Include all information about employees who do business in your state, Puerto Rico, and a state that is required to file a combined tax return with the IRS. Instructions for Form 941 (Rev. January 2016) — IRS Sep 5, 2025 — Send all tax information to the IRS using Form 941 (Rev. January 2016). Note that you will need to use this form if you are a semi-weekly schedule depositor and any of the following are true. — Employers withheld (withheld) social security and Medicare tax from employee's paychecks on any of the business' payroll period that began on or after Dec 1, 2015. If you have any questions about filing a tax return on this Form 941, contact the IRS at: Forms.AddressLineirs.gov Tax year ends December 31. Schedule B (Form 941) is filed each month the following year. Report of all federal and Puerto Rico income tax paid for a calendar year. The return should appear on a filing calendar. Schedule B — Employer's Quarterly Federal Tax Return. Schedule B, Report of Federal Tax Liabilities, and Schedule B — Employer's Quarterly Federal Tax Return, are schedules that you file each year that report federal tax to the IRS and the employee portions of social security and Medicare taxes, and the state tax portion of social security and Medicare taxes, from your employers. Form W-2 Employer's Supplemental Tax Return for Employee Contributions for Federal Insurance Contributions Act (FICA) and Additional Medicare Tax. This IRS form is used to determine whether you have to report employee contributions to social security and Medicare taxes on your Federal Tax Return or Form W-2, Wage and Tax Statement for Employees. It is also used to determine whether you have to report employee contributions for FICA and Additional Medicare Tax in your Federal Tax Return or Form W-2, Wage and Tax Statement for Employees. Instructions for Form W-2 (Rev. July 2013) — IRS Instructions for Form W-2 (Rev.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 941, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 941 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 941 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 941 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs forms 941 2025