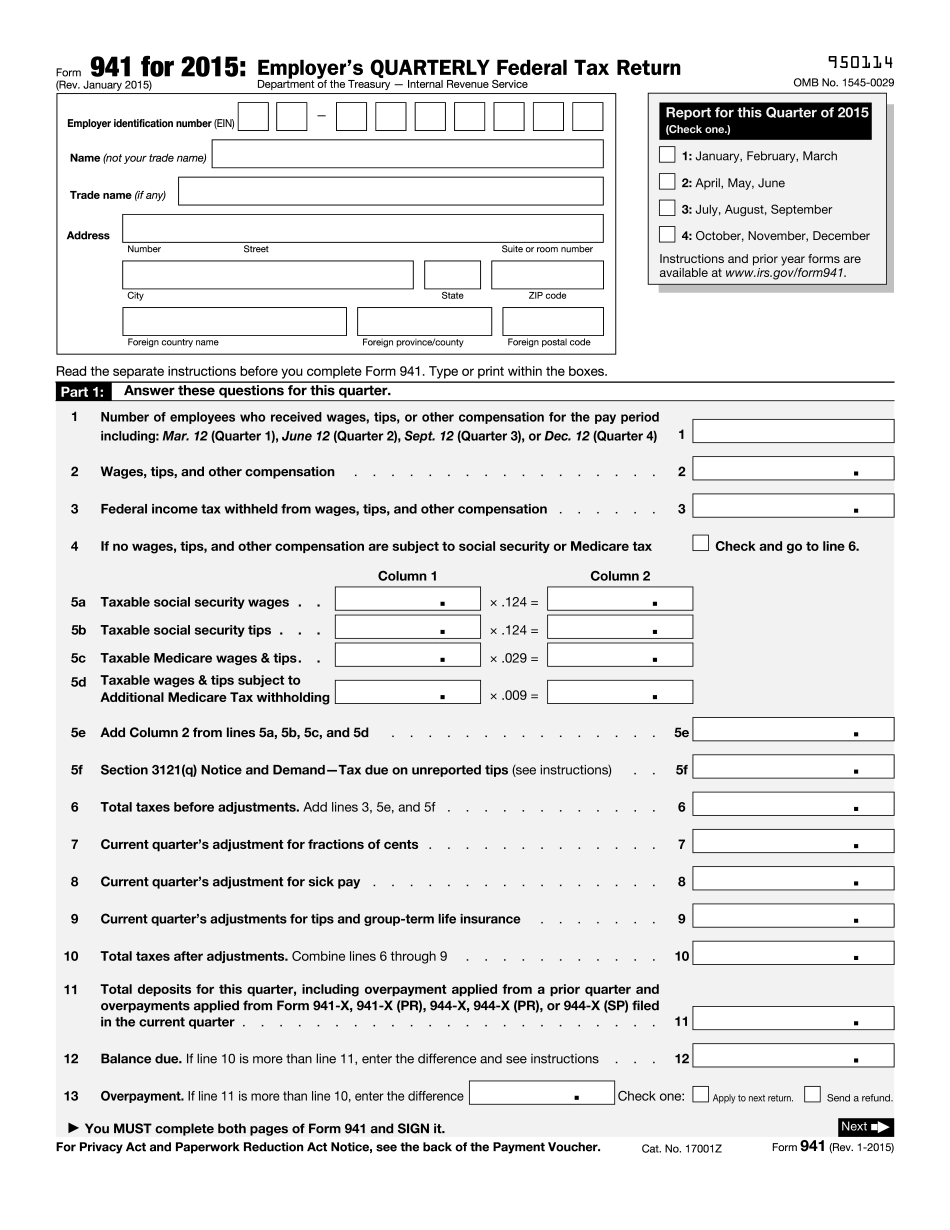

Okay guys, um, this is a video to show you how to fill out a Schedule B form that goes along with Form 941. Now, this is needed if the tax liability for the quarter is $2,500 or more. In this example, we are doing 315B for homework. So, this problem is very similar but just with slightly different numbers. The mistake that most people have when completing this form is that they forget to report both the employer and employee portions of Social Security and Medicare, which comprise the FICA tax. If we look on page 3-63 of your book, you will find Example 315B. In this example, there are several different paydays for the first quarter – January, February, and March. We are looking at the first month, which is January. On the 13th day of the first month, one of the semi-monthly paydays, the gross wages were $34,200. The FICA tax was $2,120.40. This is only one half, so we need to add the employer and employee portions together. The Medicare portion of the H&R portion is $495.90. In addition, federal income taxes withheld for all employees were $4,180. If we add all those together, we get $9,412.60. So, we just plug that into the payroll day, which was the 13th day of the first month, January. When filling out the other days, it's pretty much the same procedure. If we look at the next example, it tells us that $2,039.80 was withheld for Social Security and $477.05 was withheld for Medicare. $4,090 was withheld for federal income taxes. For each of these, we must multiply the amount withheld for FICA (Social Security and Medicare) by both the employer and employee halves. If we use the numbers for the payroll of the 31st, and add those five items together – employer...

Award-winning PDF software

2015 941 schedule b Form: What You Should Know

If you are filing a new Form 941 with respect to previously filed Forms 941-SS, don't include Forms 941-SS with your old Form 941 because The Form 941-SS Schedule C, and Schedule D, are for filing quarterly and yearly statements and are not considered as a substitute for a schedule on Form 941, as described above. ❖ To file Form 941-SS, you must complete Form 941-S (see instructions for Form 941-S), not the Form 941-SS Schedule C, and your Form 941-S should be attached to or be attached to Form 941, unless IOT TFS is exempt. If you want to include Form 941-S with your Form 941, you must obtain an amendment from your employer in which it states the pay status. Your amended Form 941 must also be attached to your Form 941, unless you have an exemption based on income from source. Once Forms 906, 906A, 906B, and 907 are attached to your Form 941, complete Form 941-S (see Instructions for Form 941-S) and send it to the IRS with a copy of both Forms 906 and 906A. You will receive Form 941-S in three to four weeks, but should be patient. The forms you need are: Form 906 (Form 906A) Form 906A (Form 906B) Form 906B (Form 906C) Form 906C (Form 906D) Form 907 (Form 907A) If you choose to amend the dates of your pay, include the Form 906, Form 906A, Form 906B, or Form 906C which have been attached to your Form 941, when you send the original to the IRS. Please do not attach a copy of the Form 906A, Form 906B, or Form 906C. You will receive Form 8379 or Form 1040-ES, and your Form 941, instead, if you submit a corrected Form 941. Additional Information Related to Schedules B, C, D, D or R — Ascents IF your Form 3903 is required under an IRS code, see IRM 9.4.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 941, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 941 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 941 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 941 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 Form 941 schedule b