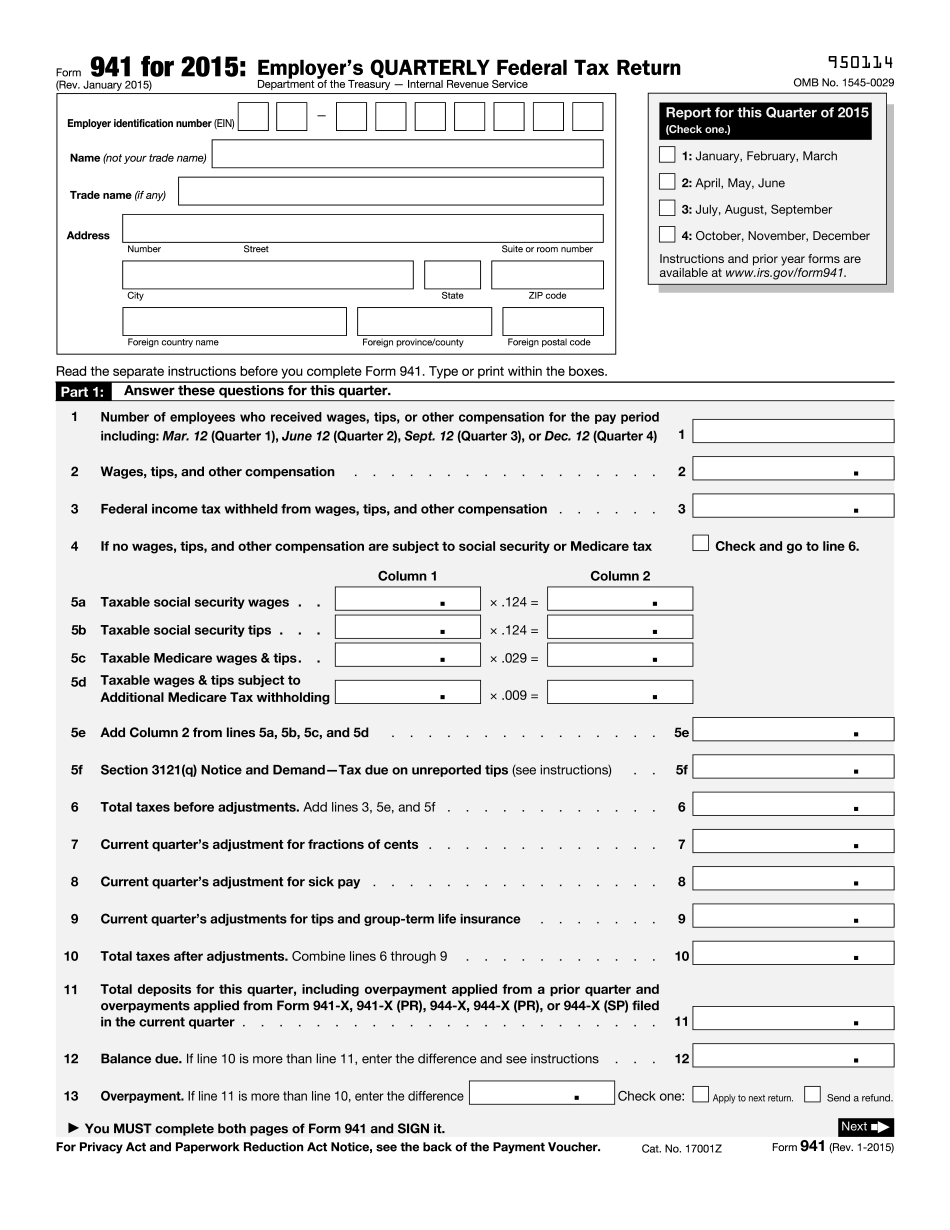

Divide this text into sentences and correct mistakes: In this video presentation, I'm going to show you how to fill out Form 941. Form 941 is used to report all FICA taxes, federal income taxes, social security, Medicare taxes to the IRS. I will use this exercise available for you and Angel to demonstrate how to fill out Form 941. John Granatelli, owner of Granatelli Motors, pays his employees monthly. The following payroll information is for the first quarter of the year (January, February, and March). Assume that the company is a monthly depositor. I have already calculated the wages for January, February, and March. Notice that no one has met the cap for OASDI. Additionally, I have calculated the OASDI, HI, and federal income tax withholdings for all employees. I have also provided the employers' portion of OASDI and HI, as well as the address, telephone number, and EIN (Employer Identification Number) for the company. Furthermore, I informed you that the number of employees on March 12th was 26. The first thing we need to do is complete Form 941 for the first quarter of the year. Let's go back to our 941. If you have the sheet of paper beside you, it would be helpful to print it out so you can follow along. The first step is to input the EIN number in the designated space. Then, we need to fill in the owner's name, which in this case is John Granatelli, and the trade name, which is Granatelli Motors. The address should be filled in as 3709 Fifth Avenue, Chicago, Illinois 60605. Additionally, we need to select the first quarter for the reporting period (January, February, March). Moving to Line 1, we need to enter the number of employees who received wages, tips, or other compensation for the pay period...

Award-winning PDF software

How to fill 2025 IRS 941 Form: What You Should Know

I, [Print name and address on here. Copy and paste the form number where your employer name is located. If you don't have a form number, call the Internal Revenue Service at and ask to see if you can get in touch with the local office. 2. I [Print name and address on here. Copy and paste the form number where your employer's name or business' name is located. If you don't have a form number, call the Internal Revenue Service at and ask to see if you can get in touch with the local office. 3. I understand that a Form W-2, Wage and Tax Statement, or Form W-2c, Electronic Data Interchange Report of Employer's Supplemental Tax Statement must be filed with my Form 941, or that a check should be made payable to the Internal Revenue Service and mailed to the address shown in line “H” on the form or in line “L” or “J” of Schedule H, Form 941 (or Schedule H-1, Form W-4, Wage and Tax Statement) if the check is mailed to me. 4. I understand that my employer has a responsibility to report the wages of employees and the tax withheld from their pay, including all taxes due from them. 5. Furthermore, I understand that I have a responsibility to verify the accuracy of the information provided on my Form 941, or form W-1. 6. Furthermore, I understand that I have a responsibility to use the information provided with Form 941 to update my federal income tax return, tax withholding requirements for the tax year, and to report to the Internal Revenue Service when I have a change of address. Furthermore, I also understand that I may need to update, amend, or correct my federal tax return to reflect any change to information reported on Form 941. 7. Furthermore, I understand that I have the right to obtain a copy of any report filed on behalf of me by the employers or other reporting organizations, and that if I do not receive a copy within 30 days of mailing the report, I may request a copy from the reporting organization. 8.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 941, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 941 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 941 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 941 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to fill 2025 IRS 941