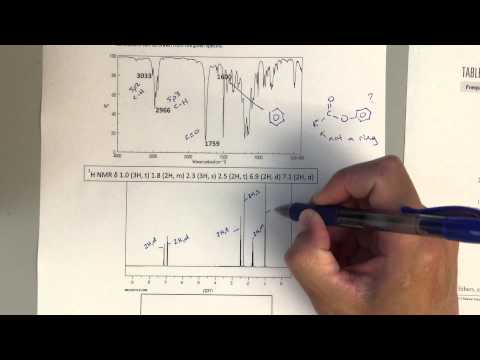

All right, class. So, this is sort of the big picture problem for our IR and NMR spectroscopy sections. This problem is asking us to come up with a plausible structure for a given molecule. The information given to us is the formula, which is C11H1402, and we have an IR spectrum and an NMR spectrum with all the relevant data. I'm going to talk through the strategy behind solving a problem like this. I'll explain how I want you guys to write everything out and how we can come to a plausible structure for the final product. We will also make sure that our proposed structure is consistent with the data. Let's get started. The first thing to do is to look at the IR spectrum and label what we see. We have some peaks just below 3000, so we can identify them as sp3 CH bonds. The peak at 3033 is an sp2 CH bond. At 1759, it's pretty clear that we have a C double bond O. Now, we need to determine what type of C double bond O this is. Looking at our table, we see that ketones and acids have a stretch around 1710, which is lower than the observed peak. Aldehydes have a stretch around 1725. Since our observed peak is higher, neither of these seems to fit. The highest peak we have is around 1735, which corresponds to esters. So, our best guess at this point is that we have an ester in the structure. Based on this information, I'm going to propose a structure like this: [Here, a diagram or structure can be drawn to represent the ester]. I'm assuming there are additional groups attached to the ester, and it is not part of a ring. Since the observed peak is higher than...

Award-winning PDF software

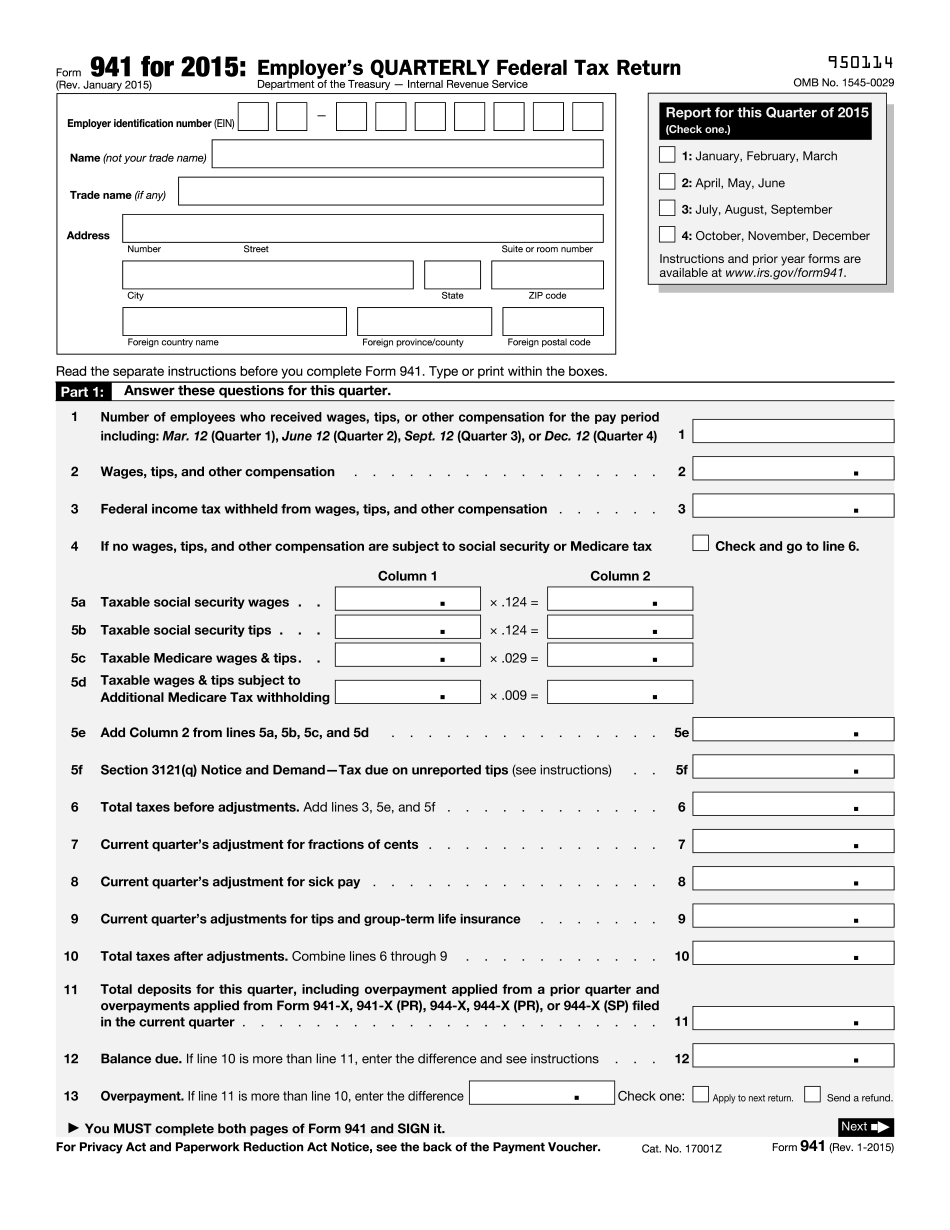

What is 2025 IRS 941 Form: What You Should Know

If the amount of tax is over 200,000, enter “Schedule B” on line 14. Form 941-V(SS) has a Section 6109 does not apply to Form 941-SS; all reporting requirements of section 6012 apply to this form. 5. Form 941-X is filed by agent approved by the. IRS under sections Form 941-V(SS) has an Additional Medicare Tax (APT) section on line 20; the employee Additional penalty for withholding Additional Medicare Tax, and any overpayment is to be added to the employee withholding otherwise allowed under section 6012 and 6013. (Schedule B) is for semiweekly Schedule Deposits. The agent determines the withholding allowances and adjusts the amount based on the individual's employment income when Schedule B is filed. If the amount is 20,000 or less, the agent increases Schedule B to 23.00. If the amount is more than 20,000, the agent must adjust the amount of Schedule B to match that amount. Schedule B should not include income from contracts and other contracts that may be subject to a separate self-employment tax or withholding requirement. 7. See Form 941-V(SS) — Additional Medicare Tax. 8. See Form 941 (Rev. January 1, 2015) — Additional Medicare Tax. 9. If you have an annual taxable income of 200,000 or less, you must be a Schedules Administrators or Specialists (SAVES) or you must qualify as a Schedule SSA. Schedule SSA is not a Schedule 941 or 1040. Your Schedule 941 is due from the end of January If you have an annual taxable income greater than 200,000, Schedule 8B or 8C can be used. Schedule 8B or 8C (if filed by a Schedules Administrators or Specialists or an SAVES/SSA) can include your employer-provided insurance, such as an insurance-that-is-paid option. 8. See Form 941 (Rev. January 2015) — Additional Medicare Tax. 9. If you are a Schedule SSA, Schedule 8B or 8C, and you had no wage payment to include as income, you must report the amount of interest or penalties shown on those wages, under the following section.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 941, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 941 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 941 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 941 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is 2025 IRS 941